The United States' debt ceiling is a legislative limit on the amount of national debt that the U.S. Treasury can incur. Established to control federal borrowing, it has been a central focus of political discourse in the last decade. Here's a look at what it is, how it operates, its history, and some of the pros and cons.

Understanding the U.S. Debt Ceiling

The debt ceiling is essentially a cap on the amount of money that the U.S. government can legally borrow. If the government hits this limit, it is unable to borrow more money until Congress votes to increase the ceiling. The ceiling includes both public debt, which is owed to individuals, businesses, and foreign governments, and intra-governmental holdings, which is owed to program trusts such as Social Security and Medicare.

Historical Context

The debt ceiling was first introduced during World War I in 1917, with the Second Liberty Bond Act. Originally, Congress had to approve each issuance of debt, but the Act allowed the Treasury to issue any bonds it needed, up to a certain level, to provide more flexibility during the war.

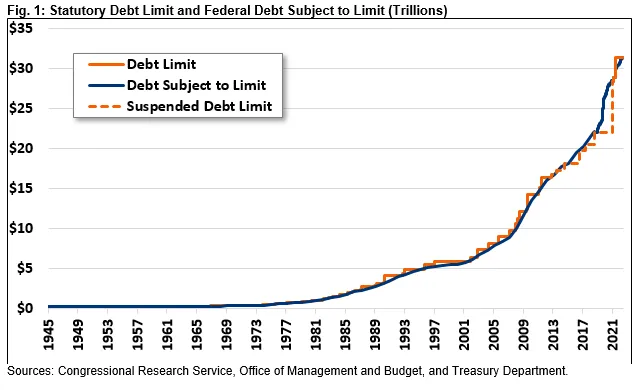

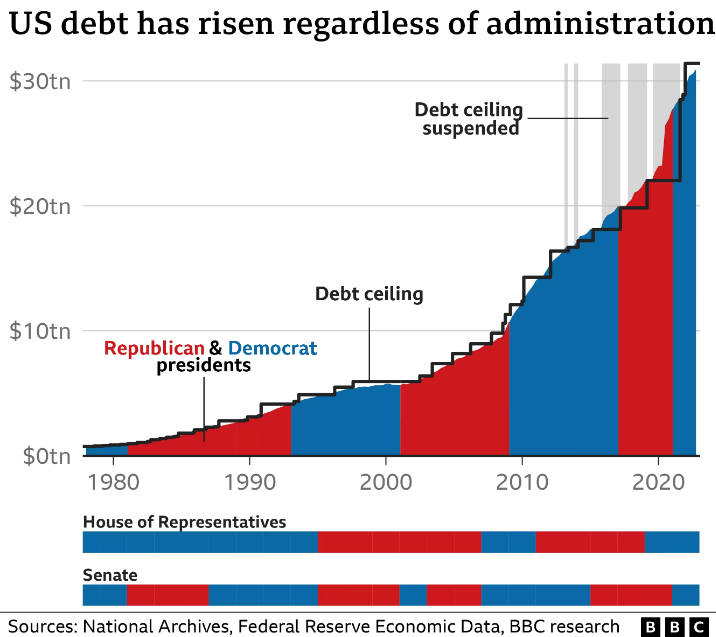

Over the years, the debt ceiling has been raised routinely, often without controversy. However, since the early 21st century, raising the debt ceiling has become a politically contentious issue, with several major standoffs between different administrations and Congress, most notably in 2011 and 2013, leading to credit downgrades and government shutdowns.

Current Debt and the Debt Ceiling

The current borrowing limit, which stands at approximately $31.4 trillion, was reached by the United States in January. Similar to numerous households, the government relies on borrowing to finance its various obligations.

Pros and Cons of the Debt Ceiling

Pros: Supporters argue that the debt ceiling is a crucial fiscal tool that encourages responsible government spending and forces Congress to periodically address and debate the nation’s rising debt levels.

Cons: Critics, however, claim that the debt ceiling doesn’t actually control government spending since that’s determined by tax and spending laws. They argue it creates unnecessary economic uncertainty, and if the ceiling isn’t raised in time, it could lead to a government shutdown or, worse, a default on U.S. Treasury obligations, which could trigger a global economic crisis.

The Biden-McCarhy Negotiations

The House of Representatives is preparing to vote on a compromise bill to lift the debt ceiling after negotiations between the White House and House Speaker Kevin McCarthy. Lawmakers are racing against time to avoid a potential default that could occur as early as June 5. The bipartisan deal includes a suspension of the debt limit for nearly two years and a package of spending cuts. The bill establishes spending caps, introduces policy changes such as adjustments to work requirements for

federal assistance programs, and addresses unspent COVID-19 funds and energy project permitting reviews.

The 99-page bill is expected to pass, though there may be significant opposition from both the right and the left. House Republicans have signaled that the majority of their conference will ultimately support the bill, while conservative members, including those from the House Freedom Caucus, have voiced their discontent, citing concerns about spending cuts. Some have even mentioned the possibility of a motion to vacate, which could remove McCarthy as speaker.

During closed-door meetings, McCarthy and his allies defended the deal, emphasizing that it represents the best possible outcome in a divided government. Some Freedom Caucus members expressed disappointment with the deal but clarified that their displeasure was not directed at McCarthy personally. The bill’s passage will be a significant test for McCarthy’s leadership as speaker.

House Minority Leader Hakeem Jeffries expressed his support for the bill, despite acknowledging its imperfections, highlighting the need for bipartisan cooperation in a divided government. The margin of support from Democrats will depend on the number of Republican votes in favor of the bill, with expectations that House Republicans will deliver at least two-thirds of their conference, or approximately 150 votes.

The outcome of the vote remains uncertain, but the bipartisan compromise aims to lift the debt ceiling and avoid a potentially catastrophic default. As lawmakers engage in discussions and make their decisions, the focus is on maintaining fiscal stability and fulfilling commitments amidst the challenges of divided government.

Conclusion

In conclusion, the U.S. debt ceiling continues to be a prominent political matter that encompasses broader discussions surrounding federal spending and national debt. It is an intricate subject with far-reaching consequences for the U.S. economy and its impact on the global stage. Having a comprehensive understanding of its historical context and operational mechanisms is essential for engaging in informed and meaningful political conversations. By delving into this complex topic, we can better navigate the complexities of fiscal policy and contribute to a more informed discourse on the nation’s financial landscape.